AHP-based Investment Decision Framework for the Film Industry

Abstract

This study examined the decision-making process of investors in the film sector, which is a major creative industry, focusing on the factors considered by venture capital investors because they balance artistic creativity and commercial viability to optimize the investment outcome. Using the Analytical Hierarchy Process methodology, first-hand data was gathered through a survey of industry experts to examine the key factors that influence film investment decisions. Although financial considerations remain significant criteria, especially return on investment and risk management, investors were also found to value aspects such as socio-cultural context and previous audience preferences. The research findings provide a framework for filmmakers aiming to secure investment and enhance scholarly understanding of the investment evaluation processes within the creative industries.

초록

본 연구는 창조 산업 내 영화 분야에서 투자자들의 의사결정 과정을 분석하여, 투자 결정 시 고려되는 핵심 요인들과 예술성 및 수익성 간의 균형점을 파악하고자 하였다. 계층분석(AHP) 방법론을 활용하여 영화 투자 결정에 영향을 미치는 주요 요인들의 우선순위를 도출한 본 연구 결과, 투자 수익률과 위험 관리와 같은 재무적 요소가 핵심 기준으로 작용하는 가운데, 사회문화적 맥락과 기존 관객들의 선호도 등 비재무적 요소 역시 투자 결정에 유의미한 영향을 미치는 것으로 나타났다. 본 연구는 영화 제작자들에게 실질적인 투자 유치를 위한 프레임워크를 제시하고, 산업 내 투자 의사 결정 프로세스에 대한 포괄적 고찰을 통해 관련 학문 분야의 이론적 발전에 기여한다는 점에서 그 의의가 있다.

Keywords:

Film Industry, Creative Industry, Film Investment, Venture Capital, Analytical Hierarchy Process (AHP)키워드:

창조 산업, 영화 산업, 영화 투자, 벤처 캐피탈1. Introduction

The Korean film industry has grown impressively in recent years, shaped by the strategic decisions of various investors. Ilshin Investment’s pioneering investment in the movie Ginkgo Bed led to a wider variety of films produced (Korea Venture Capital Association, 2021), which in turn promoted investment and international distribution of Korean films by various investors such as CJ ENM. Investors and film distributors now occupy pivotal positions in the contemporary film sector in Korea. As such, the decisions of various stakeholders, including investors and distributors, play an important role in fostering the diversification and growth of Korean cinema.

In 2024, the annual budget of the Ministry of Culture, Sports, and Tourism’s (hereafter MCST) was set at 6.96 trillion Korean Won (hereafter KRW). It provided 1.74 trillion KRW to the domestic content market by allocating 25 billion KRW to the Video Content Investment Fund and 340 billion KRW to the K-Content Fund (Ministry of Culture, Sports and Tourism, 2024). In particular, 10 billion KRW was newly allocated to fostering the development of professionals in Over-The-Top (hereafter OTT) services and broadcast video content.

Against this background, the primary objective of this study is to explore the various attributes of the creative industries and to present a decision-making methodology with a particular focus on the film industry. The study will address the following research questions: “What criteria do investors value when evaluating strategic choices in balancing innovative creativity with economic viability?” The research aims to achieve the following objectives:

- ① identify key elements shaping investment choices in film production.

- ② assess how various funding approaches generate monetary returns.

- ③ examine investment management practices across different market contexts.

- ④ develop practical recommendations applicable to multiple creative sectors.

Section 2 provides a literature review, focusing on decision-making frameworks within creative industries like film-making and examining various film funding mechanisms. Section 3 outlines the applied research methodology, which details the use of a questionnaire based on the Analytic Hierarchy Process. Section 4 presents the research findings, and Section 5 explores the implications and research constraints. Finally, Section 6 offers the overall conclusions and the insights derived from the study.

This study seeks to comprehend the intricate decision-making process within the film industry, thereby offering insights that will inform the development of future investment strategies and policies. This process enables a systematic evaluation and prioritization of a vast array of criteria.

2. Literature Review

1) Creative and Film Industries

Cunningham (2002) categorized the creative industries to include a spectrum from visual media and digital content to traditional art forms and design disciplines. Within these varied creative fields, cinema stands out as a uniquely complex and multifaceted business environment. Caves (2002) provides a thorough examination of the creative industries, including films, emphasizing the unique economic attributes that set these sectors apart from traditional industries. This insight is especially valuable for comprehending the global nature of the film sector and the various stakeholders involved in transforming a concept into a film.

2) Decision-Making in the Creative Industries

In the creative industries, particularly in film, decision-making is marked by significant uncertainty and complexity. This unique environment requires a departure from traditional strategic decision-making approaches. Caves (2002) highlights the “nobody knows” nature of creative industries, emphasizing the inherent unpredictability of demand for creative goods. Decision-making processes, especially in project selection and investment, are heavily influenced by this uncertainty.

Lampel, Lant, and Shamise (2000) considers the inherent conflicts between artistic and economic considerations in cultural industries. The study suggests that successful organizations in these industries are recommended to balance creative innovation with commercial feasibility, significantly impacting decision-making.

From the standpoint of the film industry, Eliashberg, Elberse, and Leenders (2006) offers an extensive examination of key challenges and directions. The study outlines the complexities associated with decision-making in marketing and distribution, emphasizing the necessity for comprehensive decision-making frameworks. Hadida (2009) examines the application of performance metrics in the creative industries, specifically the film sector. The study underscores the challenges in defining and measuring success within these industries, which consequently affects the processes of decision-making and evaluation. Tschang (2007) argues that decision-makers have to navigate the balance between promoting creativity and ensuring commercial viability.

Creative industries foster economic growth through innovation, urbanization, and national competitiveness, and their expansion through globalization and digitization further enhances them (Potts, 2011). As such, this industry should strike between artistic values and commercial demands for their products (Hirsch, 1972; Lampel, Lant, & Shamsie, 2000).

3) Korean Film Market

The Korean film market has experienced remarkable growth and international recognition in recent years, attracting the attention of investors and researchers alike. The financial support policy for the film industry through a specialized investment fund was implemented earlier than similar policies in other cultural sectors. In 2006, the MCST introduced a cultural industry investment fund by creating a dedicated culture account within the fund of funds. This policy transformed the capital financing structure of the film industry, offering financial support for creative projects and marking a significant departure from the existing framework (Lee, 2025).

The early adoption of these financial support policies has played an important role in the development of the Korean film market, allowing creative projects that would otherwise have been difficult to finance to be funded. This contributed significantly to the diversity and growth of industry.

However, investment in the Korean film industry presents various opportunities and challenges. While the market offers opportunities such as growing global demand for Korean content and strong government support, challenges remain in balancing regulatory oversight with investment flexibility to maximize returns.

4) Venture Capital Investment

Venture Capital (hereafter VC) firms are financial intermediaries that specialize in high-risk, high-return investments. They typically invest in innovative, early-stage companies with the potential to spread (Gompers & Lerner, 1999). To understand the VC industry, it is important to consider the entire venture cycle. This includes investing in, monitoring, and creating value to companies. The cycle continues as VCs conclude profitable deals and return capital to investors. The cycle is also renewed when the venture capitalists raise more money (Gompers & Lerner, 2001).

According to the Korea Venture Capital Association (hereafter KVCA), ventures grow through several stages. According to KVCA, venture capital functions to solve funding mismatches that occur before the stabilization stage. The amount of funding provided varies depending on the venture’s stage of growth.

In the context of financial markets, venture capitalists have played an indispensable role as intermediaries in providing capital to firms that have difficulty raising funds (Gompers & Lerner, 2001). Investment decision-making is a crucial component of the venture capital investment selection process. Zhang (2012) proposed that the core basis of venture capitalists’ investment decisions is the investment cost. Furthermore, the investment decision-making process in venture capital is marked by unpredictability and complexity. Li and Mahoney (2009) analyzed 18,678 initial investments made between 1980 and 2007, providing supporting evidence for the notion that market uncertainty has a delayed impact on the timing of initial funding, while the effects of sales growth and competition diminish this relationship.

Since 2000, VCs have been investing in film projects and have played an important role in funding low- to mid-budget movies that would otherwise have had a hard time securing enough money. By investing in portfolios of movies rather than individual projects, VCs can mitigate risk and enhance their potential for earning a higher rate of return. In contrast to typical corporate investments, film investments often feature shorter payback periods, especially when funding occurs in the later stages of production (Korea Film Council, 2020).

To differentiate this study from existing research, the study aims at providing implications by covering decision-making strategies that are broadly applicable to stakeholders in the film industry, such as venture capitalists, and to investors in other creative sectors engaged in film investments.

3. Research Methodology

1) Analytical Hierarchy Process

It is difficult to make complex decisions in an organized and effective manner. Every decision has many criteria to consider, and determining the importance and priority of the factors is even more challenging. However, prioritization is important because each factor has its own advantages and disadvantages, and one needs to reach the best conclusion under the circumstances.

Thomas Saaty’s Analytical Hierarchy Process (hereafter AHP) methodology is a structured decision-making approach that derives priorities by comparing mutually exclusive alternatives in pairs. The fundamental assumption underlying this methodology is that humans approach decision-making in a step-by-step or hierarchical manner when faced with complex problems involving multiple evaluation criteria. The advantages of this methodology include a hierarchical structure, measurability of intangibles, consistency, sensitivity analysis, and collective decision-making. In creative industries, such as film, this methodology provides a valuable framework for guiding investment decisions on projects.

Subject matter experts assign a score to each criterion using a scale from 1-9, which is subsequently compared in pairs to establish a structured framework for judgment. This assists venture capitalists in making important decisions by identifying the factors that should be prioritized within the overall context.

A pairwise comparison is a decision-making method used to determine which of two options should be assigned greater importance. AHP structures a complex process into a simplified balance sheet comparison. By organizing the various weights and alternatives involved in the investment decision, this study turns them into comparative factors. These factors are then systematically evaluated against one another, making it easier to draw conclusions for informed and effective decision-making.

To carry out a full analysis, it is necessary to organize the options for comparing each criterion. One first needs to normalize the matrix. Upon normalization, the local priority weight of each criterion is obtained by averaging the values in all rows. The final sum represents the importance of an individual criterion. While this process helps determine prioritization, an overall statistic is needed to determine the overall importance of a factor within the overall structure of each sub-criterion. To ensure the consistency of pairwise comparisons in the matrix, the Consistency Ratio (hereafter CR) is calculated <Table 2>.

Saaty recommended establishing the threshold at 0.10. If the CR exceeds this threshold, the reliability of the judgment comes into question. Decision makers adjust their judgments until the CR falls below 0.10.

Once the consistency tests are performed, AHP provides a decision range that can be applied to each component. This enables decision-makers to prioritize alternatives using a structured and mathematically sound process.

2) Research Design

The aim of this study is to examine the factors influencing investment decisions in the film sector by surveying a range of film investors, including venture capitalists, private equity investors, and other stakeholders from the creative industries.

The primary objectives of this study are to:

- ① gain expert insights into the practical and professional perspectives of film investors within the film industry.

- ② identify the key factors that film investors consider when evaluating film projects to gain a deeper understanding of the investment decision-making process.

- ③ explain contemporary investment trends and prospective outlooks with respect to the film industry through responses from investors.

- ④ facilitate the development of an investment decision-making framework for the film industry and provide a foundation for future related research.

- ⑤ provide insights into film investment criteria for film production companies or creators aiming to attract investment.

Each factor has been explored in a variety of studies, often in overlapping contexts rather than as stand-alone components.

For Filmmakers, Caves (2002) discusses star power, which extends beyond actors to overall marketability, and Ravid (1999) examines director reputation in relation to project risk. In Market Landscape, McQuail (2010) emphasizes sociocultural influences, and Elberse and Anand (2007) analyze the impact of release timing on financial performance. For Financial Considerations, Ravid (1999) examines return on investment and Goettler and Leslie (2005) examine investment structure.

This study builds on the premise of these factors and focuses on individual factors rather than treating them collectively to ensure a holistic approach to analyzing film investment.

- ① Actors: Star power and marketability, encompassing their standing in the industry, professional background, demographic factors, devoted following, and recent commercial track record (Caves, 2002).

- ② Directors: Assessment of the director’s reputation, past work experience and box office success, and expertise of cinematic approaches (Ravid, 1999).

- ③ Track Records: The production company’s past successes and awards help predict the likelihood of success for future projects (Hadida, 2009).

- ① Genre: The market viability of different film types such as romantic, suspense, comedic works shapes commercial prospects, reflecting viewer preferences and market dynamics (Desai & Basuroy, 2005).

- ② Script Quality: The overall quality of the screenplay, including stories originality, narrative structure, attractive characters, has a significant impact on the potential success and marketability of film (Krishnamurthy, 2011).

- ③ Production Budget: The comprehensive expenses involved in film creation, covering talent compensation, physical production elements, visual innovations, finishing work, and marketing initiatives (Basuroy, Desai, & Talukdar, 2006).

- ④ Film Style: The distinctive visual and sonic qualities, encompassing directorial approaches, technical presentation methods (dimensional effects), structural choices, and sonic landscapes (Basuroy, Chatterjee, & Ravid, 2003).

- ① Socio-cultural Context: Socio-cultural effects connected to the film theme or contents, such as contemporary issues, societal movements and governmental dynamics (McQuail, 2010).

- ② Timing of Release: Decisions about the best time to release a film depend on a comprehensive analysis of the competitive landscape, including the genre, size, and target audience of other films currently in the market (Elberse & Anand, 2007).

- ③ Previous Audience Preferences: Past audience behaviors, preferred narrative types, and presentation methods provides key data about successful audience engagement and revenue generation (Desai & Basuroy, 2005).

- ① Return on Investment: The expected return ratio to investment, a measure of the financial performance of a film project (Ravid, 1999).

- ② Investment Structure: Key aspects of financial agreements, including capital contribution levels, profit distribution mechanisms, and control allocations (Goettler & Leslie, 2005).

- ③ Risk Management: A strategy for identifying and managing various risks that may arise during the production and distribution of a film, including production delays, budget overruns, and box office failure (Stanton, 2017).

- ④ Exit Strategy: Strategic approaches for investment recovery, typically through distribution arrangements such as sale of distribution rights, box office sales revenue, or monetization of intellectual property associated with the film (Vogel, 2020).

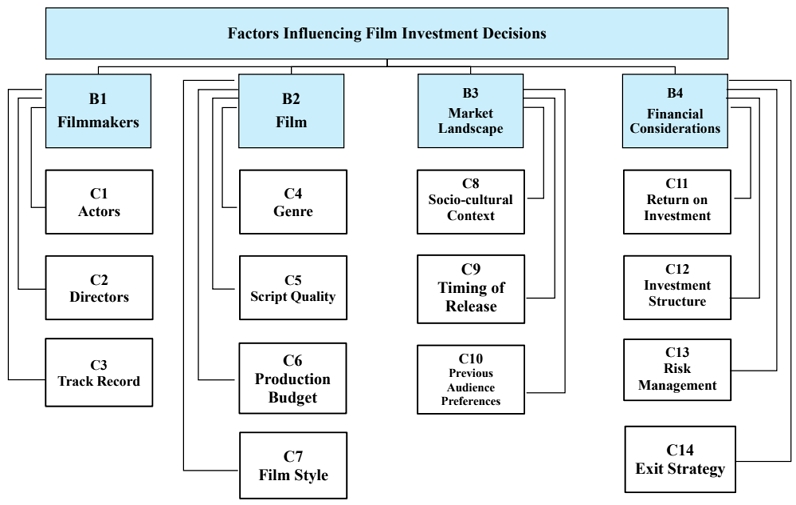

The AHP model employed here consists of four major criteria: Filmmakers, Film, Market Landscape, and Financial Considerations (B1∼B4). The model subdivides these into fourteen sub-criterion (C1∼C14) which are placed under the main criteria.

While Saaty (1980) utilizes a nine-point scale, this research simplified the scale by removing the intermediate values (2, 4, 6, and 8). This modification was made to enhance participant engagement and to reduce possible fatigue during the response process, thus lowering the likelihood of inconsistent responses. Spice Logic’s specialized AHP software was used to analyze the collected responses.

3) Data Acquisition

The survey was carried out with a sample of Korean film investors, comprising venture capitalists investing in the Korean film industry, professional investors working within the film sector, and investors focusing on the wider creative industries. The survey gathered basic demographic information from participants, including gender, age, and the specific industry in which they are employed. Additionally, questions on how long the respondents have been in the industry and how many films they have invested in were also included in the survey. The survey was targeted at Korean-speaking respondents, and the responses were collected through an online survey from October 16th to November 4th, 2024. Details of the respondents are presented in <Table 4> and <Table 5>.

First, based on the replies from the survey respondents, they were categorized according to whether they belonged to the film industry, creative industry, or other industries. The comparative assessment framework analyzed relationships between main categories and their respective sub-criteria. The primary elements were organized to capture both internal project factors and external market influences, with brief explanations provided to survey participants. The demographic information of the respondents is shown in <Table 4>.

Demographics of the survey participants reveal:

- ① a strong representation from film and creative industries (87.82%).

- ② all currently engaged in the investment industry.

- ③ all have been or are currently involved in Korean cinema funding projects.

- ④ substantial industry experience exceeding three years (84.35%).

4. Results and Analysis

Following Pauer et al. (2016) and Wedley (1993), this study employed a 0.20 consistency threshold. This higher acceptance level was adopted due to practical constraints in providing comprehensive training to each respondent regarding complex comparison procedures. A total of 115 participants completed the survey, with 41 of them meeting the 0.20 consistency threshold.

- Based on the survey results:

- ① Age Distribution: Most participants are aged 40-49 (36.58%), followed by 50-59 (26.83%).

- ② Gender: The gender distribution is slightly skewed towards males (53.66%) compared to females (46.34%).

- ③ Industry Representation: Nearly half of the participants are from sectors within the creative industry other than film (48.78%), while 43.90% are from the film sector specifically. 7.32% belongs to other industries.

- ④ Career Years: A significant number of participants have 3-6 years (39.02%) or over 10 years (31.71%) of experience.

- ⑤ Number of Film Investment Projects: 51.22% have invested in less than 3 films. 9.76% have been involved in more than 10 film projects.

1) Film Sector in Creative Industries

This section analyzes survey responses from participants involved in the film sector. There were a total of eighteen participants who were identified as currently working in the film sector, including venture capitalists and stakeholders in the film sector. The survey responses suggest that financial factors served as the key determinant in investment decisions, revealing consistent patterns throughout the decision-making process. The results by main criteria and sub-criteria are presented in <Table 6>.

2) Other Sector in Creative Industries

The priorities of investors from other creative industries, who do not specialize in film, are presented in <Table 7>. This study includes some investors who do not specialize in film, and this study aims to use these findings to propose strategies to investors in other areas of the creative industries. Therefore, this research analyzed the responses of the twenty other creative industry investors separately. This analysis will provide a more comprehensive understanding of the priorities of investors across the creative industries.

In other sectors, Financial Considerations (40.1%) is the highest priority, with Exit Strategy ranked first (0.123909) and Return on Investment third globally (0.100651). Market Landscape (25.4%) is also significant, particularly Socio-cultural Context (0.107442, ranked second globally) and Previous Audience Preferences (0.075184%, ranked sixth). Filmmakers (18.4%) follows, with Actors (0.067712, ranked eighth globally) and Track Record (0.064216, ranked ninth) being key factors. Films (16.1%) prioritize Script Quality (0.060053, ranked tenth globally), while Genre (0.030912, ranked thirteenth) and Film Style (0.023989, ranked fourteenth) are considered less important.

According to <Table 6>, the film sector prioritizes Financial Considerations (37.9%), with Return on Investment ranked first globally (0.140988), followed by Risk Management and Investment Structure. Filmmakers (26.1%) are the second priority, with Actors and Track Record being most influential. Films (18.6%) emphasize Production Budget and Script Quality, while creative factors like Genre and Film Style are less important. Market Landscape (17.4%) is the least prioritized, but Previous Audience Preferences and Timing of Release are still important.

According to <Table 8>, in both sectors, Return on Investment and Exit Strategy are important, with Return on Investment ranking highest in the film sector (0.140988) and Exit Strategy topping other sectors (0.123909). Actors are also highly prioritized in both sectors, ranking second in the film sector (0.098136) and eighth globally in other sectors (0.067712). Risk Management holds significant importance in both sectors, ranking fourth in the film sector (0.085654) and other sectors (0.096641). Creative factors like Genre and Film Style are less prioritized in both sectors, with Genre ranking lowest globally in both (0.02883 and 0.030912, respectively).

3) Aggregated Results

The aggregated results consisted of forty-one responses from people in the film sector, non-film sector in creative industries, and non-creative industries. By compiling and analyzing viewpoints from diverse domains, this study provides a more comprehensive understanding of the film sectors and the creative industries as a whole. The findings highlight distinctive investing approaches among various investor segments, contributing to the development of targeted financing strategies for creative industries.

According to <Table 9>, the aggregated ranking highlights Financial Considerations (37.8%) as the top priority, with Return on Investment globally ranked first (0.111132). Filmmakers (23.2%) is the second priority, driven by the importance of Track Record (0.0812) and Actors (0.082128), while Directors (0.068672) are ranked lower. Market Landscape (21.2%) is third, with Socio-cultural Context (0.07632) and Previous Audience Preferences (0.07102) being important. Film (17.8%) is the fourth priority, where Production Budget (0.058384) and Script Quality (0.057494) are the more important sub-criteria, while Genre (0.031862) and Film Style (0.03026) carry less weight.

5. Discussion

As suggested by <Table 9>, the aggregated ranking shows a complex decision-making structure in cinema investment, where Financial Considerations emerges as the top major criterion but must be balanced with artistic and market elements. Return on Investment and Exit Strategy emerge as the top two sub-criteria, highlighting investors’ dual focus on risk reduction and monetary returns.

Second, filmmakers are ranked as the second most important major criterion, highlighting the crucial role of human talent in the outcome of a project. The data reveals that Actors and Track Record are ranked as the fourth and fifth most important sub-criteria, highlighting the impact of star appeal and past performance on success. Directors received lower rankings, indicating that while their expertise is important, investor confidence tends to be more influenced by the marketability of performers.

This suggests that filmmakers should adopt a data-driven approach to demonstrate the marketability based on Actors and Track Record over creative leadership. For instance, Na Hong-jin’s “The Chaser” (2008), a debut feature film based on a true story, leveraged the star power of actors Kim Yun-seok and Ha Jung-woo. Despite a modest production budget of 2.6 billion KRW, the film surpassed 5 million viewers, demonstrating how renowned actors can elevate a first-time director’s work. Similarly, Yeon Sang-ho’s “Train to Busan” (2016), his first live-action film distributed by Next Entertainment World, exemplifies how a relatively unknown director can achieve global recognition through distributor track records, robust studio marketing and international festival exposure, ultimately becoming a global zombie film phenomenon. Hwang Dong-hyuk’s “Squid Game” (2021), his first television series, achieved global acclaim through a combination of compelling storytelling and Netflix’s global distribution platform, illustrating how emerging talent can break through industry barriers with strategic partnerships and powerful production track records.

Third, market landscape ranks third, revealing how external factors influence investment decisions. Previous Audience Preferences hold considerable weight, suggesting that historical viewing trends inform decisions, though they are ranked below financial and talent-related criteria. Although the Film category ranks last among major criteria, its components offer valuable insights into content evaluation.

These findings provide crucial insights for industry stakeholders. Despite the artistic nature of filmmaking, investors, particularly VCs, aim to minimize risks while managing uncertainty. This is achieved through structured financial models, diversified revenue streams (e.g., Internet Protocol Television, OTT), and careful analysis of market trends. In the film industry context, VCs emphasize the marketability of actors and the track record of filmmakers, using these as key indicators of a project’s financial potential. By adopting a data-driven approach, filmmakers can align their proposals with investors’ needs, ultimately promoting sustainable growth within the Korean film industry. In addition, this industrial approach may accelerate due to the post COVID-19 shift in distribution channels.

6. Conclusions

This study analyzes investment decision-making in the film industry, with a particular focus on venture investments. First, financial structure plays a critical role, necessitating clear revenue models and transparent profit-sharing mechanisms due to the industry’s diverse revenue streams. Second, the expertise of key filmmakers, including actors and directors, is also a significant factor. Using both quantitative and qualitative methods, this study evaluate the capabilities of production teams, considering their industry networks, past achievements, and expertise.

Third, the study indicates that market trend is also the important element considering investment decision process, necessitating thorough analysis of consumer preferences, competitive positioning, and distribution strategies, with insights from similar projects informing unique market advantages.

The limitations of this study is that Financial Considerations may act as preconditions or underlying factors for Filmmakers, Films, and the Market Landscape, which may lead to causal effects in expert responses. For instance, producers can be a key of risk management. This means that the interactions between these factors may not be fully captured, limiting our understanding of the overall investment climate. However, despite these limitations, the findings still have practical implications as investment decisions are made in the aggregated, rather than in isolated.

Additionally, according to Korea Film Council’s notice about video specialized investment funds (2024), out of 25 film-specialized investment funds established under the Korea Fund of Funds, only 12 funds are currently active and under management as of October 2024, excluding funds that have completed their investment period. This represents approximately 1% of the 938 are active Korea Fund of Funds subsidiary funds (Korea Venture Investment Corp, 2024). This limited sample potentially introduces individualized decision-making processes that may overshadow broader film investment trends. Nevertheless, the findings retain practical significance, given that investment decisions are made holistically, with factors being considered in combination rather than isolation. Recent changes in theatrical distribution post COVID-19 and the diversification of distribution channels also have the possibility of influencing investment criteria.

In addition, the relevance of the findings extend across creative sectors. As boundaries between film, television, music, advertising, and digital content continue to blur, these investment principles provide valuable guidance for the wider creative economy. In addition, the influence of technological advancements and shifting consumer behavior patterns highlights the necessity for adaptive strategies to sustain competitive advantages across creative industries.

Future research may be beneficial in the following areas. First, there is room for more extensive qualitative research, including in-depth investor interviews, case studies, and observations of the investment decision process. Second, the interactions between various investment factors may be further explored to create more comprehensive performance models. Third, studying the changing market environment is essential, particularly in relation to consumer behavior shifts and new revenue models in the platform era. Fourth, the recent emergence of OTT platforms has blurred the lines between film and other media formats, making it important to consider films that are suitable for these platforms rather than strictly adhering to the traditional notion future research needs to examine of theatrical release. Therefore, it is important for future research to examine investment decision-making factors specific to the OTT environment, such as media compatibility, programming strategy, and platform suitability. Such an expansion of scope could contribute to the development of a unified investment decision model by identifying commonalities and differences across creative sectors, which would ultimately benefit both investors and industry professionals.

In conclusion, as creative industries continue to transform and evolve, investment opportunities are expanding. However, successful investment in these industries necessitate a multifaceted approach that considers financial factors, key personnel, and the market environment. Further research will offer a deeper understanding of the investment decision-making process in the creative industries, including the film sector, helping both investors and producers navigate the intricate landscape of the creative industry.

Acknowledgments

This paper is a substantially revised version based upon the thesis submitted by Sumin Lee in partial fulfillment of the requirements for M.A. in International Studies at Korea University. Professor J.H. Kim’s contribution to this work was supported by a Korea University Grant (K2405821).

References

- Altunok, T., Ozgur, O., Yiğit, K., & Recai, Y. (2010). Comparative Analysis of Multicriteria Decision-Making Methods for Postgraduate Student Selection. Eurasian Journal of Educational Research, 10, 1-15.

-

Basuroy, S., Chatterjee, S., & Ravid, S. (2003). How Critical Are Critical Reviews? The Box Office Effects of Film Critics, Star Power, and Budgets. Journal of Marketing, 67(4), 103-117.

[https://doi.org/10.1509/jmkg.67.4.103.18692]

-

Basuroy, S., Desai, K., & Talukdar, D. (2006). An Empirical Investigation of Signaling in the Motion Picture Industry. Journal of Marketing Research, 43(2), 287-295.

[https://doi.org/10.1509/jmkr.43.2.287]

- Caves, R. E. (2002). Creative Industries: Contracts Between Art and Commerce. Cambridge: Harvard University Press.

-

Cunningham, S. (2002). From Cultural to Creative Industries: Theory, Industry and Policy Implications. Media International Australia, 102(1), 54-65.

[https://doi.org/10.1177/1329878X0210200107]

-

Desai, K. K., & Basuroy, S. (2005). Interactive Influence of Genre Familiarity, Star Power, and Critics’ Reviewsin the Cultural Goods Industry: The case of motion pictures. Psychology & Marketing, 22, 203-223.

[https://doi.org/10.1002/mar.20055]

-

Elberse, A., & Anand, B. (2007). The Effectiveness of Pre-Release Advertising for Motion Pictures: An empirical investigation using a simulated market. Information Economics and Policy, 19(3-4), 319-343.

[https://doi.org/10.1016/j.infoecopol.2007.06.003]

-

Eliashberg, J., Elberse, A., & M. A. Leenders (2006). The Motion Picture Industry: Critical issues in practice, current research, and new research directions. Marketing Science, 25(6), 638-661.

[https://doi.org/10.1287/mksc.1050.0177]

- Florida, R. (2003). The Rise of the Creative Class: And How It’s Transforming Work, Leisure, Community and Everyday Life. New York: Basic Books.

-

Goettler, R. L., & Leslie, P. (2005). Co-financing to Manage Risk in the Motion Picture Industry. Journal of Economics & Management Strategy, 14(2), 231-261.

[https://doi.org/10.1111/j.1530-9134.2005.00041.x]

-

Gompers, P., & Lerner, J. (1999). What Drives Venture Capital Fundraising? In Baily, M. N., Winson, C., & Reiss, P. C. (Eds.) Brookings Papers on Economic Activity (pp. 149-204). Wanshington D.C.: Brookings Institution Press.

[https://doi.org/10.3386/w6906]

-

Gompers, P., & Lerner, J. (2001). The Venture Capital Revolution. Journal of Economic Perspectives, 15(2), 145-168.

[https://doi.org/10.1257/jep.15.2.145]

-

Hadida, A. L. (2009). Motion Picture Performance: A review and research agenda. International Journal of Management Reviews, 11(3), 297-335.

[https://doi.org/10.1111/j.1468-2370.2008.00240.x]

- Hesmondhalgh, D. (2007). The Cultural Industries. Sage: Thousand Oaks.

-

Hirsch, P. M. (1972). Processing Fads and Fashions: An Organization-Set Analysis of Cultural Industry Systems. American Journal of Sociology, 77(4), 639-659.

[https://doi.org/10.1086/225192]

- Howkins, J. (2013). The Creative Economy: How People Make Money from Ideas. London: Penguin Books.

- Hwang, D. H. (Director). (2021). Squid Game [Television Series]. Netflix.

- Im, S. Y., & Lee, Y. C. (2017). A Comparative Case Study of Factors Determining Documentary Films’ Success. The Journal of the Korea Contents Association, 17(10), 503-517.

- Korea Venture Capital Association. (2021). Venture Capital’s past and future memories. VC Discovery Webzine, 159. https://webzine.kvca.or.kr/202109/?idx=21, (2025.03.29. search)

- Korea Venture Investment Corp. (2024). Market Watch International Edition, 13, 1-55.

- Korean Film Council (2020). Decreased Investment Appeal of the Film Industry from an Investor’s Perspective and Countermeasures. https://www.kofic.or.kr/kofic/business/guid/introVideoInvestment.do

- Korean Film Council. (n.d.). Video Specialized Investment Funds. https://www.kofic.or.kr/kofic/business/guid/introVideoInvestment.do, . (2025.02.04. search)

- Krishnamurthy, N. (2011). Film Review Aggregators and Their Effect on Sustained Box Office Performance. Claremont McKenna College, California, USA.

-

Lampel, J., Lant, T., & Shamsie, J. (2000). Balancing Act: Learning from organizing practices in cultural industries. Organization Science, 11(3), 263-269.

[https://doi.org/10.1287/orsc.11.3.263.12503]

- Lee S. (2025). Decision-Making Strategies for Venture Investments in Creative Industries: AHP Approach Focused on the Film Sector. Korea University, Seoul: Korea.

- Lee, K. S. (2020). A study on the development plan of the domestic film industry through the window theory of opportunity. The Journal of the Korea Contents Association, 20(7), 195-202.

-

Lee, Y. J., & Shin, H. D. (2013). The Effects of the Existence and Type of Originals on Box-office Performance. The Journal of the Korea Contents Association, 13(6), 108-115.

[https://doi.org/10.5392/JKCA.2013.13.06.108]

-

Li, Y., & Mahoney, J. T. (2011). When are Venture Capital Projects Initiated? Journal of Business Venturing, 26(2), 239-254.

[https://doi.org/10.1016/j.jbusvent.2009.08.001]

- McQuail, D. (2010). Mass Communication Theory (6th ed.). London: SAGE Publications.

- Ministry of Culture, Sports and Tourism. (2024). MCST to Prioritize Support for Youth, Vulnerable Groups, Industries, and Regions in 2024. https://www.mcst.go.kr/english/policy/pressView.jsp?pSeq=347, (2025.03.29. search)

- Na, H. J. (Director). (2008). The Chaser [Film]. Showbox.

-

Pauer, Frédéric., Katharina Schmidt., Ana Babac, Kathrin Damm, Martin Frank, & J.-Matthias Graf von der Schulenburg. (2016). Comparison of Different Approaches Applied in Analytic Hierarchy Process - An Example of Information Needs of Patients With Rare Diseases. BMC Medical Informatics and Decision Making, 16(1), 1-11.

[https://doi.org/10.1186/s12911-016-0346-8]

-

Potts, J. (2011). Creative Industries and Economic Evolution. Cheltenham: Edward Elgar Publishing.

[https://doi.org/10.4337/9780857930705]

-

Ravid, S. A. (1999). Information, Blockbusters, and Stars: A Study of the Film Industry. The Journal of Business, 72(4), 463-492.

[https://doi.org/10.1086/209624]

- Saaty, T. L. (1980). The Analytic Hierarchy Process: Planning, Priority Setting, Resource Allocations. New York: McGraw-Hill.

- Stanton, M. J. (2017). A Theoretical Application of Metaphor Research to the Film Industry. East Tennessee State University, Tennessee: USA.

-

Tschang, F. T. (2007). Balancing the Tensions Between Rationalization and Creativity in the Video Games Industry. Organization Science, 18(6), 989-1005.

[https://doi.org/10.1287/orsc.1070.0299]

-

Vogel, H. L. (2020). Entertainment Industry Economics: A Guide for Financial Analysis (10th ed.). Cambridge: Cambridge University Press.

[https://doi.org/10.1017/9781108675499]

-

Wedley, William C. (1993). Consistency Prediction for Incomplete AHP Matrices. Mathematical and Computer Modelling, 17(4-5), 151-161.

[https://doi.org/10.1016/0895-7177(93)90183-Y]

- Yeon, S. H. (Director). (2016). Train to Busan [Film]. Next Entertainment World.

-

Zhang, X. (2012). Venture Capital Investment Selection Decision-Making Base on Fuzzy Theory. Physics Procedia, 25, 1369-1375.

[https://doi.org/10.1016/j.phpro.2012.03.248]

Appendix

Appendix. Survey Sheet AHP Analysis of Factors Influencing Film Investment Decisions

“Factors Affecting Film Investment Decision-making by Venture Capitalists”

I would like to thank you for your participation in this survey. Your input will be invaluable in helping us to analyze the factors involved in investment decisions in the film industry.

This survey is designed to gain insight into the investment decision-making process in the film industry from the perspective of venture capital (VC) investors.

This will help us to understand the relationship between the high-risk, high-return nature of the film industry and the performance of VC investments.

Your responses will be invaluable in identifying the factors that VC investors consider important when evaluating film projects and understanding current investment trends and prospects.

This will contribute to the development of an investment decision-making model for the film industry and provide a basis for future related research. Furthermore, the findings of this study will offer valuable insights into the investment decision-making criteria of venture capitalists for film production companies and creators seeking investment.

Considering the growing trend of various investments in the Korean film industry, your professional insights will play a pivotal role in guiding the industry’s development.

If you have any questions or require any further assistance during the survey, please do not hesitate to contact me at via email at s2suminlee@korea.ac.kr

This research is being conducted by Sumin Lee.

I would like to thank you once again for taking the time to complete the survey.

* Your responses will never be used outside of this study and will be securely destroyed after a period of time *

* Please agree to all continue:

* Please indicate your age:

* Please indicate your gender:

* Please indicate which industry you work in:

* Please indicate your current work experience:

* How many film investment projects have you been involved in?

* Please indicate the type of business you represent: (Venture Capital Firm, Investment Firm, mainly focusing on Film Investment or Not Film investment, etc.)

Survey Instructions

This survey will employ the Analytic Hierarchy Process (AHP) method. To ensure clarity and transparency in this research process, I will first provide a brief explanation of how this method will be applied:

Understanding the Comparative Scale

You will be presented with pairs of options in the example as “A” (on the left side) and “B” (on the right side), along with a comparative scale from 0 to 9. Your task is to determine the relative importance of A compared to B, based on the following scale:

- 1: A is extremely more important than B

- 2: A is very strongly more important than B

- 3: A is strongly more important than B

- 4: A is moderately more important than B

- 5: A and B are equally important

- 6: B is moderately more important than A

- 7: B is strongly more important than A

- 8: B is very strongly more important than A

- 9: B is extremely more important than A

Consistency in Responses

It is crucial to evaluate the consistency of your responses. This entails more than simply distinguishing preferences; it also involves determining the extent to which responses are logically validated through consistency verification.

If A is more important than B (A>B) and B is more important than C (B>C), then, A should be more important than C (A>C). If possible, please avoid to choose 5 (neutral) to provide more crucial insights.

1. Internal Factors of Filme

Actors: The influence and appeal of an actor, including the actor’s reputation, experience, age, gender, fan base, and box office performance of their recent work.

Directors: Consideration of the director’s reputation, the experiences and box office performance of their past work, and expertise in a particular genre or style.

Track Record: The past success experiences and awards records of the production companies help predict the likelihood of success for future projects.

Genre: The popularity of specific genres (e.g., romance, action, thriller, comedy, etc.) influences the commercial potential of a film, reflecting market trends and audience preference.

Script Quality: The overall caliber of the screenplay, including factors such as originality, narrative structure, character development, and dialogue, significantly impacts a film’s potential success and marketability.

Production Budget: The total cost of film production, including cast and crew wages, set construction, special effects, post-production, and promotion.

Film Style: The visual, aural, and narrative qualities of a film, including the director’s distinctive style of expression, cinematography (3D, 4D, etc.), editing style, use of music, and acting direction.

2. External Factors of Film

Socio-cultural Context: The external environment that may be relevant to the subject matter or content of the film, such as current social issues, cultural trends, and political situations.

Timing of Release: The decision regarding the optimal release timing for a film is contingent upon a comprehensive analysis of the competitive landscape, encompassing the genre, scale, and target audience of other films currently available in the market.

Previous Audience Preferences: Understanding previous preferences including their favored genres, and film styles, provides valuable insights into the types of films that attracted viewership and generated higher consumer spending.

Return on Investment: The ratio of expected return to investment, a metric that measures the financial performance of a movie project.

Investment Structure: Includes the key terms of an investment agreement, such as the investor’s share of the total production cost, profit-sharing structure, and decision-making rights.

Risk Management: A strategy for identifying and managing various risks (production delays, budget overruns, box office failure, etc.) that may occur during the production and distribution of a film.

Exit Strategy: A plan for how and when an investor will realize a return on investment, typically through mechanisms such as selling distribution rights, earning revenue from box office sales, or monetizing intellectual property related to the film.

[MAIN SURVEY STARTS HERE]

* Which is more strongly affects Film Investment: Filmmakers or Films?

* Which is more strongly affects Film Investment: Filmmakers or Market Landscape?

* Which is more strongly affects Film Investment: Filmmakers or Financial Considerations?

* Which is more strongly affects Film Investment: Films or Market Landscape?

* Which is more strongly affects Film Investment: Films or Financial Considerations?

* Which is more strongly affects Film Investment: Market Landscape or Financial Considerations?

[SUB-CRITERIA 1. “FILMMAKERS”]

* Which is more strongly affects Film Investment: Actors or Directors?

* Which is more strongly affects Film Investment: Actors or Track Records?

* Which is more strongly affects Film Investment: Directors or Track Records?

[SUB-CRITERIA 2. “FILMS”]

* Which is more strongly affects Film Investment: Genre or Script Quality?

* Which is more strongly affects Film Investment: Genre or Production Budget?

* Which is more strongly affects Film Investment: Genre or Film Style?

* Which is more strongly affects Film Investment: Script Quality or Production Budget?

* Which is more strongly affects Film Investment: Script Quality or Film Style?

* Which is more strongly affects Film Investment: Production Budget or Film Style?

[SUB-CRITERIA 3. “MARKET LANDSCAPE”]

* Which is more strongly affects Film Investment: Socio-cultural Context or Timing of Release?

* Which is more strongly affects Film Investment: Socio-cultural Context or Previous Audience Preferences?

* Which is more strongly affects Film Investment: Timing of Release or Previous Audience Preferences?

[SUB-CRITERIA 4. “FINANCIAL CONSIDERATIONS”]

* Which is more strongly affects Film Investment: Return on Investment or Investment Structure?

* Which is more strongly affects Film Investment: Return on Investment or Risk Management?

* Which is more strongly affects Film Investment: Return on Investment or Exit Strategy?

* Which is more strongly affects Film Investment: Investment Structure or Risk Management?

* Which is more strongly affects Film Investment: Investment Structure or Exit Strategy?

* Which is more strongly affects Film Investment: Risk Management or Exit Strategy?

This is the end of the survey, and thanks to your participation.

I’ve been able to enrich my master’s thesis.

Thank you again for your time.

If you have any questions or suggestions, please don’t hesitate to contact me.

Sumin Lee

s2suminlee@korea.ac.kr

October 2024