Interaction Effect of Public Pension and Housing on Individual Pension Purchase

Abstract

This study examined the interaction effects of public pension status and homeownership on individual pension purchase and contribution levels in South Korea. While public pensions play a crucial role in alleviating financial difficulties during old age, they do not provide adequate retirement security. This inadequacy has heightened the importance of individual pensions in retirement planning. This research explored how the interplay between public pensions and homeownership influences the decision to purchase private pensions and the amounts contributed. Utilizing data from the Korea Fiscal Panel and employing a Double Hurdle Panel Model, the study revealed significant interaction effects, suggesting that the combination of public pensions and homeownership substantially impacts individual pension behavior. Specifically, the results indicated a significant complementary relationship between public pensions and homeownership in relation to individual pension purchases. Homeowners with generous public pensions are more inclined to purchase individual pensions. This complementary relationship may be driven by precautionary motives and liquidity constraints.

초록

본 연구는 공적연금과 주택 소유의 상호작용이 개인연금 구매에 미치는 효과를 분석한다. 공적연금과 노후에 겪을 수 있는 재정적 어려움을 완화하는데 주요한 역할을 한다. 그러나 한국의 경우 공적연금이 노후보장적 측면에서 부족한 부분이 상당하여 개인연금의 중요성이 점점 커지고 있다. 이런 개인연금의 확대를 통해 개인의 노후 대비를 강화하기 위해서는 개인연금과 유사한 기능을 하는 요인들과의 관계를 파악할 필요가 있다. 본 연구에서는 개인연금의 가입에 미치는 공적연금과 주택소유의 영향에 대해 주목하였다. 특히 공적연금과 주택소유의 상호작용이 개인연금에 어떠한 영향을 미치는지 파악하고자 하였다. 이를 위해 한국 재정 패널 데이터에 더블허들 모형(Double Hurdle Panel Model)을 적용하여 분석하였으며, 내생성의 통제를 위해 통제함수를 활용하였다. 분석결과, 공적연금과 주택 소유의 상호작용이 개인연금의 가입에 유의한 정적 영향을 가지고 있는 것으로 나타났다. 주택을 소유한 사람 중 관대한 공적연금을 받는 사람들이 개인연금을 구매할 가능성이 더 높았다고 해석할 수 있다. 이러한 결과는 저축에 대한 예방적 동기와 유동성 제약에 의해 촉진된 것으로 판단된다.

Keywords:

Individual Pension, Public Pension, Homeownership, Old Age Preparation키워드:

개인연금, 공적연금, 국민연금, 주택자산, 노후보장1. Introduction

Many old age people suffer from financial difficulty. This often leads to serious individual and social problems, as financial distress in old age can easily make them slide into poverty. Also, because this experience is usually caused by losing income after retirement, it can commonly occur to all retirees. This universal problem is particularly painful for senior citizens in South Korea (hereafter Korea), as about half of retired Koreans consider their main problem in old age are economic difficulties and furthermore, 40.4% of Korean senior citizens are living under poverty as of 2023 (OECD, 2023).

Among several ways to address the financial difficulty, the pension system—both public and private— is considered one of the most stable and effective solutions. Pensions are designed to prevent the total loss of income after retirement and to alleviate the burden of financial difficulties in old age. They serve as solid support and a key preventative measure against poverty during retirement. Typically, a replacement rate of roughly 70% of gross income is considered adequate for retirement from a variety of pension sources; however, the benefit level of the public pension system in Korea is far from sufficient to support a stable life in old age, as the replacement rate in Korea has fallen to 40% (Kang & Choi, 2010) following public pension reform in 2007.

There is a growing expectation that the gap between the ideal replacement rate and actual coverage should be filled by the individual (Joo, 2009; Orenstein, 2013). In such an environment, it is natural that the role of the private sector in the pension system becomes increasingly important. However, the private sector’s role in Korea is limited, as only a small proportion of the population is insured through it. Although there has been slight growth in individual pension systems, the participation rate was only around 19% as of 2022 (Statistics Korea, 2024). If the current situation is not addressed, it may be not possible to avoid severe and prolonged old-age poverty in Korea.

In response to these challenges, this study examines critical factors that heavily influence individual pension purchases, especially public pension and homeownership, and their interaction. First one is public pension; one of the main purposes of purchasing an individual pension, is to cope with the low replacement rate of the public pension and to secure future income. Therefore, the purchase level of private savings is largely affected by the adequacy of public pension provisions and other retirement planning measures. And because the public pension is a major source of future income for many individuals, it can have a considerable effect on an individual pensions.

Another important feature that can affect individual pension participation is a homeownership, as this can be another important potential ‘future income’. Purchasing a house is not just buying a place to live, but it also is serves as forced savings and asset accumulation. Hence, homeownership also has a similar role in old age; it can provide income in old age and protects individuals from poverty (Doling & Elginsa, 2012; Doling & Ronald, 2010; Ronald & Doling, 2012; Torricelli, Brancati, & Santantonio 2016).

Public pension and individual pension benefits become a direct income source for the retiree. They buffer household financial vulnerability by strengthening livelihood strategies and may help reduce the intensity of poverty. Similarly, homeownership contributes in more indirect ways. When a mortgage is paid off and the house becomes debt-free, residential expenses can be dramatically reduced compared to renting, which often consumes a large part of a household’s budget (Johnson, 2015). This becomes particularly beneficial in later years when consistent income may no longer be available, as they would be able to get by on a smaller budget. Moreover, the equity in a home provides a critical financial resource; homeowners can capitalize on their property by selling or downsizing, thus converting it into liquid assets when needed. Thus, individual pension, public pension and homeownership share a crucial role in ensuring financial stability and security for retirees. Together, they provide a multi-faceted approach to managing financial risks in old age.

The three factors not only just share a role as a ‘future income’. Yet, there is another similarity among them; they all occur during one’s working time, within the boundary of a limited budget—usually an income. Which means, they have parallel growth over ones’ working years and eventually have a competing relationship. Notably, mandatory public pension contributions and home purchases are two cases of substantial and consistent expenditure that must be paid concurrently over many years. The public pension participation status and homeownership status can significantly influence an individual’s budget constraints, and thus can impact the level of individual pensions, which also requires a considerable and ongoing financial commitments (Cristini & Sevilla, 2014).

Considering their parallel growth during the work years and functional similarity in later life, it is rational to assume the interaction effect between public pension and homeownership on individual pension purchase. The decision to purchase an individual pension can be altered significantly by how the two factors interplay; for instance, individuals with both a pension and a house may have different pension purchasing behaviors compared to those who either have high pension contributions but no house or low pension contributions with a house. That is, different coordination of public pension and house purchases will affect one’s financial limitations and needs for old-age preparation. Thus, examining the effect of the combined effect of public pension and house purchases on individual pension participation will be valuable in understanding how individuals prepare for retirement.

While previous studies have explored the individual roles of public pension and homeownership in shaping retirement savings separately, they have generally not addressed their interactive effects on individual pension outcomes. This study aims to bridge this gap by empirically investigating how the interplay between public pension status and homeownership affects individual pension contributions and participation. By focusing on the combined effects of these variables, this research seeks to provide new insights into retirement preparation strategies, offering a unique contribution to the field that extends beyond the scope of prior investigations.

2. Literature Review

In this section, the relationships among individual pension, public pension, and homeownership will be examined through theoretical frameworks. Additionally, the functional similarities and parallel growth of these three factors will be explored to better understand their complex interplay in retirement planning. By reviewing these aspects, more accurate anticipation of how their interactions might influence these outcomes.

1) Relationship between Public Pension and Individual Pension

There are two major theories that explain the relationship between public pension and individual pension: the Life Cycle Theory and the Extended Life Cycle Theory. According to the original Life-Cycle Model, public pensions have a substitutive (or crowd-out) relationship with personal savings and pensions; participation in a public pension can decrease private savings or individual pension purchases and vice versa (Kim, 2017; Poterba, 2001). This substitution effect occurs because individuals expect to receive public pension benefits after retirement, which often exceed their original contributions, thereby reducing their incentive to save privately. This is particularly pronounced among those less able to afford substantial savings.

Contrarily, the Extended Life-Cycle Model suggests that public pensions can have a complementary (crowd-in) relationship with personal savings. Scholars advocate this model through different mechanisms: The retirement effect, precautionary motives, liquidity constraints, among others. Retirement effect argues that public pensions can prompt earlier retirement, increasing the need for private savings to cover a longer retirement period (Feldstein, 1974). Precautionary motives, influenced by uncertainty about lifespan and health in old age (Kimball, 1990), can lead to increased savings as individuals prepare for potential future financial needs. Liquidity constraints refer to a limited access to immediate funds, making individuals more cautious about their future income uncertainties. The higher these constraints, the more likely individuals are to increase their savings as a precautionary measure, leading to greater overall savings outcomes. With these mechanisms, the Extended Life-Cycle Model provides a robust framework for understanding the complementary relationship between public pensions and personal savings.

Empirical studies on the relationship between public pensions and individual pensions in Korea yield mixed results. For instance, Kim (2013), utilized simulations with the Korean Labor and Income Panel Study (KLIPS) data and found a substitutive effect between public and individual pension participation. In contrast, other studies have found complementary or non-significant effects: Jeon, Im, and Kang (2006), Kim, Lee, Kim, & Kang (2015) observed that higher public pension contributions were associated with increased individual pension contributions. Studies by Jeon and Im (2008), Moon (2012), Yoo (2020) found no significant relationship between public pension and individual pension participation or contribution amounts. The conflicting research results can largely be attributed to theoretical differences; the different interpretations of the Life Cycle and Extended Life Cycle theories may be reflected in these empirical studies, with these opposing perspectives naturally leading to divergent findings. Additionally, variations in data, analysis methods, variables used1), may have affected the competing results.

2) Relationship between Housing and pension

Life-Cycle theory and Trade-off theory explains the negative relationship between housing and pension. Housing plays a crucial role in the saving and dissaving processes of individuals, aligning with the Life-Cycle Model. This suggests that individuals smooth consumption by purchasing housing, repaying mortgages during their working years, and liquidating housing assets upon retirement (Feinstein & McFadden, 1989). Generally, purchasing housing is negatively correlated with private savings or individual pensions (Choi, 2011; Jones, 1997; Krumm & Kelly, 1989), as the substantial financial commitment required for housing reduces the available resources for other forms of savings.

Kemeny’s Trade-Off theory also explains the negative relationship of the two aspects2). Two primary mechanisms influence this interaction (Castle, 1998; Doling & Elsinga, 2012; Doling & Horsewood, 2011; Kim, 2019): constraint-induced and need-induced. The constraint-induced mechanism suggests that higher mortgage payments can limit pension contributions, creating a negative correlation. Conversely, the need-induced mechanism indicates that homeowners, living rent-free in retirement, may require smaller pensions, thereby reducing the necessity for larger pension savings and potentially decreasing their pension purchases.

However, the empirical research on the relationship between homeownership and pensions shows mixed results3). At the macro level, Castle (1998) analyzed the relationship between social welfare expenditure and homeownership rates, controlling for GDP, aging populations, and family structures, and found an inverse relationship between homeownership and pension expenditure in OECD countries. However, Stamso (2010) and Van Gunten and Kohl (2019) suggest a complementary relationship. Stamso (2010) examined the relationship between homeownership and changes in public social expenditure, using control variables such as the Gini coefficient, GDP, and housing policy trends. Van Gunten and Kohl (2019) explored the relationship between homeownership and pensions, controlling for factors like public and private debt levels, GDP, unemployment rates, inflation, life expectancy, aging populations, etc. Both studies found a positive relationship between homeownership and pension expenditure. Only a handful of studies have been conducted at the micro level: Müller (2019), Torricelli et al. (2016), and Kim (2019) found trade-off effects, indicating that homeownership can negatively impact individual pension amounts, thus supporting a competitive relationship between housing investments and pension savings.

3) Interaction Effect of public pension and homeownership

Building on the theoretical frameworks discussed earlier, this section explores the potential interdependencies between public pensions and homeownership regarding individual pension. It is important to understand how these factors collectively impact retirement outcomes. The core idea is that decisions regarding private pensions are shaped by the broader financial context, including public pension benefits and housing assets. This section will particularly consider the ‘shared role’ these elements play in securing financial stability in retirement and their ‘parallel growth’ during working years, which lays the foundation for anticipating a significant interaction effect.

Public pension and homeownership provide crucial financial security in old age by offering income and reducing financial burdens.

The pension system was designed to prevent old age poverty by serving as a major income in retirement years. Studies by Englehardt and Gruber (2004), Engelhardt, Gruber and Perry (2005), Korpi and Palme (1998), Smeeding (2001), and others have shown that social security significantly improves living conditions and reduces poverty rates among the elderly. In Korea, similar studies by Kwon (2000), Hong (2005), and Kim and Kwon (2007), show that expanded coverage and greater pension generosity are key factors in poverty alleviation. Without these benefits, the poverty rate and severity among older adults would be much higher.

Likewise, homeownership also significantly alleviates old age poverty. High housing costs are typically the largest household expenditure, placing a heavy burden on older adults without homeownership. Morris (2016) found that elderly homeowners could maintain a reasonable standard of living with public pension benefits, while non-homeowners faced financial distress. Delfani, De Deken, & Dewilde (2014) noted that high housing costs can lead to poverty even for those with pension income. Bradbury (2010) and Choi (2011) similarly emphasized that higher housing costs increase the risk of poverty in old age. Both pensions and homeownership are critical for protecting against poverty in later life.

To fulfill the ‘shared role’ at a later age, public pension, individual pension and homeownership have to undergo parallel growth during the working period. Both pension contribution and mortgage repayment periods require long-term financial commitments that typically overlap throughout one’s life span. Individuals in Korea typically start contributing to public pensions when they start working, usually in their 20s, as participation is mandatory in Korea. Home purchases can occur at various life stages; and since a house usually is a high-priced good, people generally get mortgages and repay the loan for extensive periods.

Furthermore, both housing payment and pension contribution involve a substantial amount of capital to be paid. Individuals are required to pay 9% of their income as a public pension contribution4). According to the recent Korean Housing Affordability Index (K-HAI), housing mortgages account for about 15% of average household income (Kim, 2019), emphasizing the significant financial commitment involved. The persistent and substantial contribution to public pension and housing naturally and inevitably impacts the household budget, savings and consumption.

Similar to public pension and housing, individual pension also requires individuals to pay a given amount of contribution for a substantial period, on a regular basis. Although the purchase amount or period can differ among people, the individual pension also has parallel growth to public pension and homeownership. Furthermore, individual pension grows within the limited resources along with public pension and housing purchase; it needs to compete with other factors. In other words, all three contributions occur within the boundary of an individual’s income during one’s life cycle, which makes individual pensions inevitably be influenced by the other two.

Based on these arguments and theories, this study expects an interaction effect between public pension, homeownership and individual pension purchase. Theoretically, individuals manage their financial decisions across multiple assets—such as housing and pensions—based on expected financial security and liquidity needs during retirement. Thus, the impact of housing on individual pensions might differ according to the level of public pension, and vice versa: the purchase of individual pension is largely determined by both housing status (homeownership) and public pension, and how these two factors interact. For instance, homeowners with substantial public pensions may feel less need for additional pension savings, as they may feel more financially secure for retirement. However, they might face financial constraints due to significant mortgage repayments and pension contributions, which could reduce their motivation to invest in individual pensions or lead to smaller contributions.

In contrast, those with less substantial public pensions or without homeownership face different financial considerations. Lacking either a secure home asset or a generous pension may increase the need for additional savings to secure financial stability in retirement, leading to higher participation in individual pensions. This highlights how public pensions and homeownership function not in isolation but as interconnected components of an individual’s broader financial strategy.

In conclusion, the interaction between public pension and homeownership can significantly shape individual pension decisions, highlighting the importance of understanding how these factors collectively influence retirement planning. Therefore, it is crucial to consider the combined effects of public pension and housing when promoting individual pension participation and ensuring long-term financial security for retirees.

3. Research Question

While substantial research has been conducted on the relationships between public pensions, private pensions, and homeownership independently, there is a notable gap in the literature regarding the combined impact of public pensions and homeownership on individual pension outcomes. Given the close interrelation among these factors, addressing the interaction effect represents a significant gap in the research that needs to be explored.

Based on these considerations, this study aims to examine the interaction effects of public pension status and homeownership on the likelihood of participating in individual pension and the amount of contribution Specifically, this study addresses the following research question: Are there interaction effects between public pension status (including contribution amount) and homeownership on the decision to purchase private pensions and the level of contributions made? Does having a generous pension scheme and a greater contribution level among homeowners reduce the need for private pension plans?

4. Methodology

1) Data

This study used the National Survey of Tax and Benefit (NaSTaB) panel data, wave 2 to 12, provided by the Korea Institute of Public Finance5). It surveys approximately 5,600 households (7,500 family members of 15+ years old with income) throughout the country on various socio-economic background information; including subjects of income, expenditure, assets, real estate, transfers, welfare, debts, tax credit, and more. The target data is the head of the household6) between 20 and 60, the active working age groups before pensionable age, and the final sample contains 3,461 individuals.

2) Variables

In order to test the effect of public pension and housing on individual pension purchase, two dependent variables are used depending on the research question: individual pension participation and average monthly individual pension purchase amount7). Individual pension participation was coded as 0 (non-participant) and 1 (participant); for the monthly purchase amount, the actual value was used while non-participant and participant with no contribution were coded as 0. Independent variables are the interaction of public pension (public pension types, public pension participation amount) and housing (homeownership): which are type*ownership, and amount*ownership. Public pension types were categorized into non-participants, NPS (national pension system), and SOP (special occupational pension); generally, it is known that NPS participants receive better institutional benefits than non-participants, while SOP participants receive more generous benefits than NPS participants (Kim, 2017). The amount of public pension participation was used as a continuous variable. The homeownership variable was classified into homeowners and non-homeowners8). Lastly, control variables were chosen based on previous studies related to individual pension purchase. Those factors include gender, age, job position, marital status, number of children, secondary housing, non-cash assets, and cash assets9).

3) Analytical Method

In studies where a significant portion of the population opts not to engage in a particular activity, such as purchasing an individual pension, the resulting data often contains a large proportion of zero values, indicating non-participation. This leads to the issue of a left-censored dependent variable at zero, where traditional regression models may not be suitable.

In previous studies, Probit models were typically used to analyze the decision to participate, while Tobit models were applied independently to examine the level of purchase or contribution. However, this approach has a few limitations. The Probit model is primarily designed for binary outcomes, meaning it models the decision to participate but does not account for the level of participation. This limitation makes it less suitable for situations where the extent of engagement (e.g., the amount of contribution) is also of interest. On the other hand, the Tobit model, while capable of handling censored data, it is restrictive because it assumes the same factors influence both decisions, overlooking that different factors could affect participation and contribution levels. Furthermore, the Tobit model does not separate the decision-making process into distinct stages, potentially oversimplifying the complex reality of individual decision-making (Yen & Huang, 1996). Consequently, these models may not fully capture the decision-making involved in individual pension participation and contribution.

The Double Hurdle model provides a more integrated and holistic approach by allowing these two stages of decision-making—the decision to participate and the decision on the level of engagement or contribution—to be analyzed as related processes rather than isolated events. This allows for a better understanding of the decision-making and captures the complexities of the actual phenomenon more effectively.

By applying the Double Hurdle model to panel data, this study is able to investigate how public pension participation and homeownership jointly influence both the likelihood of participating in an individual pension plan and the extent of contributions made, providing a more comprehensive analysis of the factors that shape individual pension decisions.

The estimation process follows a subsequent procedure. It addresses two separate hurdles: the first hurdle models the probability of participation through a Probit model, while the second hurdle, conditional on surpassing the first, models the level of purchase using a truncated regression model (Solomon, Tessema, & Bekele, 2014).

The double hurdle panel model has a participation equation:

And a purchase level equation:

is a latent participation indicator is a latent contribution zt and xt are vectors of explanatory variables, and α and β are conformable vectors of parameters. Errors are independent and normally distributed, while error term ∈t is truncated.

Another important issue that needs to be addressed in the analysis is the problem of endogeneity. This study assumes that the purchase level of individual pension will be greatly influenced by housing as well as public pension (type and contribution level); but housing and pension might be related according to previous studies. This implies that pension and housing are highly likely to have an endogenous relationship, which needs to be modified before performing Probit and Tobit analysis. This study chose to use a Control Function, which is often applied in other similar settings, such as Garbero and Marion (2018), Ricker-Gilbert, Jayne, and Chirwa (2011), Suarez-Varela & Dinar (2017), Yu, Zhu, Breisinger and Hai (2013), and more.

The control function approach follows subsequent steps: endogenous variables are regressed on exogenous regressors, instruments, and control variables, and the generalized residuals are retrieved. Then, the estimated residual is included in the original function as a covariate(s) in the model. After including the residuals in the main model, a bootstrapping method can be used to validate the robustness of the results.

4) Analytical Model

This study utilizes four analytical models to explore the interaction effects between homeownership and public pension variables on individual pension outcomes. Model 1 examines the effect of the interaction between homeownership and pension type on individual pension participation. Model 2 analyzes how the interaction between homeownership and pension type impacts the amount of individual pension contributions. Model 3 investigates the influence of the interaction between homeownership and pension contribution levels on individual pension participation. Model 4 assesses how the interaction between homeownership and pension contribution levels affects the amount of individual pension contributions.

5. Result

1) Basic Statistics

<Table 1> presents the socio-demographic characteristics of the sample of analysis10). Among the total of 3,461 participants, about 21.1 percent participated in the individual pension programs, while 78.9 percent were not. The average individual pension contribution was about 69,610 KRW (SD=214.21). A majority of participants were NPS participants (67.8 percent), followed by non-participants (24.9 percent) and SOP participants (21.1 percent); the average monthly public pension contribution was 102,250 KRW (SD=92.60). In terms of homeownership, 55.1 percent were known to have a house, while 44.9 percent were not owners.

2) Interaction effects of homeownership and public pension status

This analysis examines the interaction effect of housing (homeownership; HO) and public pension participation status (non-participants, NPS, SOP) on individual pension purchase, and the result is presented in <Table 2>. In Model 1, the interaction term (interaction 1) of homeownership and NPS had a significant positive effect on individual pension participation (β=0.1919, p<0.001). In the same token, the interaction term (interaction 2) of homeownership and SOP also had a significant positive effect on individual pension participation (β=0.2122, p<0.01). Meanwhile, the interaction effect of homeownership and public pension status on individual pension purchase amount (Model 2) did not show statistical significance.

According to trade-off theory, generous pensions and homeownership should have a negative relationship, but the result is in the opposite direction. Homeowners and individuals in generous pension schemes are more inclined towards individual pension purchases, indicating a complementary relationship. This finding contradicts the theory that suggests a substitutive relationship between generous pensions and housing. Instead, the results support a complementary relationship among public pension, housing, and individual pension.

One of the possible reasons for this complementary relationship, among many theoretical rationals is the precautionary motive. As mentioned Korea has a public pension system with very weak generosity; thus, the public pension is obviously not high enough to be relied upon as the sole income source in old age, which is perceived as an aspect that needs to be supplemented by other means, such as individual pensions. The uncertain sustainability of public pensions also can be another possible reason: According to the NPS Fund Management Committee (2023), there will be a deficit in the fund starting from 2041 and the fund is expected to be exhausted by 2055. News about pension fund exhaustion and experience downsizing of public pensions through pension reforms might have triggered the precautionary motive among Korean people. This uncertainty, combined with weak generosity, might stimulate the precautionary motive, leading Koreans to prepare for additional individual pension purchases.

Liquidity constraints also might served as a motive for better savings and individual pension outcomes. Liquidity constraints can make individuals more cautious about future income uncertainties. The higher the liquidity constraints, the more individuals become precautionary, which can lead to greater individual pension outcomes. Having both a pension and a house represents a high liquidity constraint, which might drive the increase in individual pension participation. The complementary relationship observed in the interaction effect can be attributed to the mixed and combined influence of these factors. As these effects combine, it can be predicted that homeownership and public pensions together lead to an increase in individual pension purchases.

The model 2, on the other hand, showed that both interactions (HO*NPS, HO*SOP) did not have a specific effect on individual pension purchase amount; the homeowners with NPS or SOP did not have significantly better individual pension purchase amount compared to the non- owners, non-participants groups.

The lack of significant impact on individual pension purchase amounts, despite the positive effect on participation, can be rooted in the distinct decision-making processes: the decision to participate in an individual pension plan and the decision regarding the amount to contribute may involve different processes and be influenced by different factors. For instance, the decision to participate might be more influenced by precautionary motives and general financial stability, encouraging individuals to secure a basic level of retirement preparation. In contrast, the contribution amount might be more sensitive to short-term financial constraints, such as the ones faced by homeowners with ongoing mortgage payments.

3) Interaction Effects of homeownership and public pension contributions amount

The next models examine the interaction effect of housing (homeownership) and public pension contribution on individual pension purchase, and the result is presented in <Table 3>. Model 3 and 4 examined the interaction effect of public pension contribution and homeownership on individual pension purchase. The result shows the interaction term of contribution amount and homeownership (interaction 3 in Model 3) has a positive effect on individual pension participation (β=0.0682, p<0.001). Model 4 on the other hand, showed that the interaction effect of contribution and homeownership on individual pension amount turned out to be non-statistically significant (β=-0.0144, p>0.1).

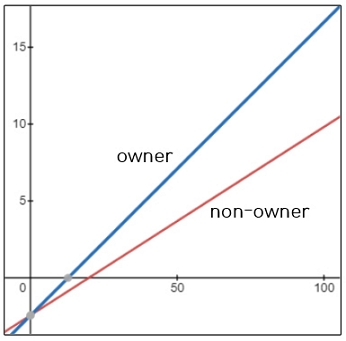

The result of model 3 indicates that homeowners with higher contribution amounts tended to have a better chance in individual pension participation. In other words, compared to non-owner groups, the owner group’s effect of contribution on individual pension participation is greater; and this difference grows as contribution increases <Figure 1>. This reinforces the complementary relationship between pensions and housing. Instead of trade-off relationship between higher public pension contributions and housing, the results affirm a complementary relationship among public pensions, housing, and individual pensions. As previously discussed, the reasons for this complementarity likely stem from a combination of precautionary motives and liquidity constraints. Individuals anticipating economic instability, may save more or seek additional pension coverage to mitigate risks associated with uncertain future income and restrictions on immediate financial liquidity.

Lastly, the result of Model 4 shows that a greater amount of contribution with homeownership did not have a superior amount of individual pension purchase. Both homeowner and non-owner group experience the same increase in probability according to a contribution change.

6. Conclusion

1) Summary of findings

This study is purposed to investigate the interaction effect of public pension and homeownership on individual pension purchase. The interaction effect of homeownership and public pension (status, contribution amount) was investigated, and the summary of the result is presented in <Table 4>.

The result indicates there was interaction effects between homeownership and public pension (both status and contribution) on individual pension participation, while there was no interaction effect between homeownership and public pension on the individual pension purchase amount. This means homeowner group with public pension (NPS or SOP) or homeowners with higher public pension contribution tended to have a better chance of participating in an individual pension.

2) Contribution and Implication

This study makes a contribution by elucidating the complementary relationship between housing, public pension, and individual pension in Korea, using double hurdle analysis. It was found that individuals participating in generous public pension schemes or those with higher public pension contributions, as well as homeowners, generally had better outcomes in terms of individual pension participation. Thus, this supports the extended life-cycle theory; precautionary motives—stemming from the weak generosity of the public pension and the uncertain future of pension policy—and liquidity constraints explain these complementary relationships. This study also has a contribution to the academic field that this is the very first study that investigated the interaction effect of public pension and homeownership on individual pension purchase. It was assumed that the arrangement of public pension and housing would alter individual pension purchase behaviors, and meaningful interaction effects were indeed found. This highlights need to analyze public pensions and housing together.

Several policy implications can be drawn from this study. The complementary relationship which was found in this study indicates that those with stronger household economies are better positioned to achieve better individual pension outcomes, while those with lower public pension contributions, non-public pension participants, and non-homeowners face a greater risk of exclusion from the individual pension system. In other words, those who are already economically advantaged, such as homeowners or those with substantial public pension benefits, are more likely to further enhance their retirement security through individual pension plans. This trend represents that the risk of widening inequality in retirement particularly if economically vulnerable groups are not adequately supported.

The study’s findings could be highlighting the importance of aiding these disadvantaged individuals in participating in individual pension plans. To address these disparities, policy interventions are needed to enable economically disadvantaged people to join individual pensions, thereby fostering a more inclusive retirement security system. Germany’s ‘Riester Pension’ could serve as a good model to intervene this problem: The Riester pension was started in 2002 to expand the role of the individual pension to compensate for the reduction in the level of public pension benefits (Moon, 2012; Ryu, 2012). It provides a direct and substantial level of subsidy to the amount of individual pension one purchases. This has been useful practical method to aid the mid/low-income groups to participate in the individual pension system in Germany. Also, since subsidies are available only to those who participate in the public pension system, this model promotes public pension participation and reduces blind spots in the public pension system. By 2011, about 50 percent of Riester Pension participants were from the mid- to low-income group, earning less than 20,000 euros annually (Ryu, 2012). Adopting a similar program in Korea could be a practical way to help economically disadvantaged individuals participate in individual pensions, thereby addressing the limitations of the complementary relationship.

In addition, financial literacy program should be widely implemented. There is a clear need for targeted financial literacy programs, given that wealthier individuals are more likely to benefit from the complementary relationship between homeownership and public pensions, These programs could focus on educating lower-income households about the importance of participating in individual pension schemes. By improving financial literacy, the government can help bridge the gap between different economic groups and promote more equitable retirement planning.

It might not be ideal to rely heavily on individual pensions for old age preparation, as they tend to lack sustainability, and are highly market-dependent. However, in a situation where public pensions fail to guarantee sufficient financial security in retirement—and with the current situation where improvement is not likely in the near future— the necessity of individual pensions becomes evident. If the government cannot provide an adequate level of public pensions, it has a responsibility to encourage workers to prepare for old age through individual pensions. Implementing such policies can foster a more inclusive and effective pension system, ensuring financial security for all citizens in their retirement years.

3) Limitations

First, this study was unable to incorporate the effects of the retirement pension system. Retirement pensions can play a significant role in providing future income and may have a notable impact on individual pension outcomes. Unfortunately, due to data limitations, this variable could not be included in the analysis. The NaSTaB dataset contained information on retirement pensions for only about 1 percent of the total sample, making meaningful analysis impractical. An attempt was made to use Workers’ Compensation Insurance as a proxy, given the overlap in coverage between the two systems. However, data on Workers’ Compensation Insurance was also unavailable. Due to these data limitations, retirement pensions were not included in the analysis.

Second, while homeownership is a useful variable for the analysis model, variables such as ‘housing mortgage’ or ‘percentage of housing mortgage payment in income’ would offer a more detailed insight into the dynamics explored in this study, considering the theoretical framework. Unfortunately, housing mortgage payment data was also not available in NaSTaB (or other panel datasets), which limited the analysis. These limitations should be addressed in future research when more comprehensive data becomes available.

Acknowledgments

This paper is based on a revised portion of Kim Soyeon’s PhD dissertation.

Notes

References

- Bradbury, B. (2010). Asset rich, but income poor: Australian housing wealth and retirement in an international context. FaHCSIA Social Policy Research Paper, 41.

- Castles, F. G. (1998). The really big trade-off: Home ownership and the welfare state in the new world and the old. Acta politica, 33, 5-19.

-

Cristini, A., & Sevilla, A. (2014). Do House Prices Affect Consumption? A Re‐assessment of the Wealth Hypothesis. Economica, 81(324), 601-625.

[https://doi.org/10.1111/ecca.12098]

-

Delfani, N., De Deken, J., & Dewilde, C. (2014). Home-ownership and pensions: Negative correlation, but no trade-off. Housing Studies, 29(5), 657-676.

[https://doi.org/10.1080/02673037.2014.882495]

-

Doling, J., & Elsinga, M. (2012). Housing as income in old age. International Journal of Housing Policy, 12(1), 13-26.

[https://doi.org/10.1080/14616718.2012.651298]

-

Doling, J., & Horsewood, N. (2011). Home Ownership and Pensions: Causality and the Really Big Trade off. Housing, Theory and Society, 28(2), 166-182.

[https://doi.org/10.1080/14036096.2010.534269]

-

Doling, J., & Ronald, R. (2010). Property-based welfare and European homeowners: how would housing perform as a pension? Journal of Housing and the Built Environment, 25(2), 227-241.

[https://doi.org/10.1007/s10901-010-9184-7]

-

Engelhardt, G. V., & Gruber, J. (2004). Social security and the evolution of elderly poverty (Working Paper No. 10466). Cambridge: National Bureau of Economic Research. https://www.nber.org/papers/w10466

[https://doi.org/10.3386/w10466]

-

Engelhardt, G. V., Gruber, J., & Perry, C. D. (2005). Social security and elderly living arrangements evidence from the social security notch. Journal of Human Resources, 40(2), 354-372.

[https://doi.org/10.3368/jhr.XL.2.354]

- Feinstein, J., & McFadden, D. (1989). The Dynamics of Housing Demand by the Elderly: Wealth, Cash Flow, and Demographic Effects. In The economics of aging (pp. 55-92). Chicago: University of Chicago Press.

-

Feldstein, M. (1974). Social security, induced retirement, and aggregate capital accumulation. Journal of political economy, 82(5), 905-926.

[https://doi.org/10.1086/260246]

- Garbero, A., & Marion, P. (2018). Understanding the dynamics of adoption decisions and their poverty impacts: The case of improved maize seeds in Uganda. IFAD Research Series, 28, 1-61.

- Johnson, R. W. (2015). Housing costs and financial challenges for low-income older adults. Washington D.C.: Urban Institute.

-

Jones, A. (1997). The tenure transition decisions for elderly homeowners. Journal of Urban Economics, 41(2), 243-263.

[https://doi.org/10.1006/juec.1996.1099]

- Kemeny, J. (1980). The myth of home-ownership: Private versus public choices in housing tenure. London: Routledge.

-

Kemeny, J. (2001). Comparative housing and welfare: Theorising the relationship. Journal of Housing and the Built Environment, 16(1), 53-70.

[https://doi.org/10.1023/A:1011526416064]

-

Kemeny, J. (2005). “The really big trade‐off” between home ownership and welfare: Castles’ evaluation of the 1980 thesis, and a reformulation 25 years on. Housing, Theory and Society, 22(2), 59-75.

[https://doi.org/10.1080/14036090510032727]

-

Kemeny, J. (2006). Corporatism and housing regimes. Housing, Theory and Society, 23(1), 1-18.

[https://doi.org/10.1080/14036090500375423]

-

Kimball, M. S. (1990). Precautionary saving and the marginal propensity to consume (No. w3403). Cambridge: National Bureau of Economic Research. https://www.nber.org/papers/w3403

[https://doi.org/10.3386/w3403]

-

Korpi, W., & Palme, J. (1998). The paradox of redistribution and strategies of equality: Welfare state institutions, inequality, and poverty in the Western countries. American Sociological Review, 65(5), 661-687.

[https://doi.org/10.2307/2657333]

-

Krumm, R., & Kelly, A. (1989). Effects of homeownership on household savings. Journal of Urban Economics, 26(3), 281-294.

[https://doi.org/10.1016/0094-1190(89)90002-8]

-

Morris, A. (2016). A qualitative examination of Jim Kemeny’s arguments on high home ownership, the retirement pension and the dualist rental system focusing on Australia. Housing, theory and society, 33(4), 484-505.

[https://doi.org/10.1080/14036096.2016.1190785]

- Müller, K. (2019). Essays on housing and pensions: A European perspective. Wiesbaden, Germany: Springer Gabler.

- OECD. (2023). Pensions at a glance 2023: OECD and G20 indicators. Paris: OECD Publishing.

-

Orenstein, M. A. (2013). Pension privatization: Evolution of a paradigm. Governance, 26(2), 259-281.

[https://doi.org/10.1111/gove.12024]

-

Poterba, J. M. (2001). Annuity markets and retirement security. Fiscal Studies, 22(3), 249-270.

[https://doi.org/10.1111/j.1475-5890.2001.tb00042.x]

-

Ricker-Gilbert, J., Jayne, T. S., & Chirwa, E. (2011). Subsidies and crowding out: A double‐hurdle model of fertilizer demand in Malawi. American Journal of Agricultural Economics, 93(1), 26-42.

[https://doi.org/10.1093/ajae/aaq122]

-

Ronald, R., & Doling, J. (2012). Testing home ownership as the cornerstone of welfare: Lessons from East Asia for the West. Housing Studies, 27(7), 940-961.

[https://doi.org/10.1080/02673037.2012.725830]

- Smeeding, T. M. (2001). Income maintenance in old age: What can be learned from cross-national comparisons (LIS working paper series, No. 263). Luxembourg: LIS Cross-National Data Center.

- Solomon, T., Tessema, A., & Bekele, A. (2014). Adoption of improved wheat varieties in Robe and DigeluTijo Districts of Arsi Zone in Oromia Region, Ethiopia: a Double-hurdle Approach. African Journal of Agricultural Research, 9(51), 3692-3703.

-

Stamso, M. A. (2010). Housing and welfare policy-changing relations? A cross‐national comparison. Housing, Theory and Society, 27(1), 64-75.

[https://doi.org/10.1080/14036090902764216]

- Suárez-Varela, M., & Dinar, A. (2017). A Double-Hurdle Approach for Estimation of Bottled Water Demand under Consumer Environmental Attitudes and Water Conservation Policies (USR SPP Working Paper Series, 17-01). Riverside, CA: UC Riverside.

-

Torricelli, C., Brancati, M. C. U., & Santantonio, M. (2016). Does homeownership partly explain low participation in supplementary pension schemes? Economic Notes: Review of Banking, Finance and Monetary Economics, 45(2), 179-203.

[https://doi.org/10.1111/ecno.12054]

-

Van Gunten, T., & Kohl, S. (2019). The inversion of the ‘really big trade-off’: homeownership and pensions in long-run perspective. West European Politics, 43(2), 435-463.

[https://doi.org/10.1080/01402382.2019.1609285]

- Yen, S. T., & Huang, C. L. (1996). Household demand for Finfish: A generalized double-hurdle model. Journal of Agricultural and Resource Economics, 21(2), 220-234.

-

Yu, B., Zhu, T., Breisinger, C., & Hai, N. M. (2013). How are farmers adapting to climate change in Vietnam. Endogeneity and sample selection in a rice yield model (IFPRI Discussion Paper 1248). Washington D.C.: International Food Policy Research Institute.

[https://doi.org/10.2139/ssrn.2235620]

- 강성호·최옥금 (2010). 기초노령연금의 탈빈곤 효과 및 계층별 소득보장 효과 분석. <한국사회정책>, 17(2), 43-71.

- 권문일 (2000). 국민연금 급여수준의 적절성 평가. <비판사회정책>, 7, 11-38.

- 김대철·권혁진 (2007). 국민연금제도의 노후빈곤 완화 효과분석: 국민연금 직장가입자(임금근로자)를 중심으로. <사회보장연구>, 23(3), 251-275.

- 김소연 (2019). 자가주택 소유가 사적연금 가입 및 가입액에 미치는 영향에 관한 연구. <사회과학연구>, 45(1), 229-253.

- 김시언 (2019). 정책변화가 부동산 가격에 미치는 영향에 관한 연구. 한성대학교 대학원 경제부동산학과 박사학위논문.

- 김예슬 (2017). 공적연금이 개인연금에 미치는 영향: 가구소득계층별 분석을 중심으로. 서울대학교 대학원 사회복지학과 석사학위논문.

- 김원섭·이용하·김치완·강성호 (2015). 개인연금가입과 납부액의 결정요인에 대한 연구. <조사연구>, 16(4), 87-114.

- 김재호 (2013). 개인연금 가입결정과 유지요인에 관한 분석. <보험금융연구>, 24(4), 3-29.

- 류건식 (2012). 취약계층을 위한 노후소득보장 방안 모색: 사적노후소득보장을 중심으로. <한국사회보장학회 정기학술대회 논문집>, 2012(1), 41-73.

- 문용필 (2012). 중고령자의 개인연금 가입에 영향을 미치는 요인: 패널자료를 활용한 분석. <노인복지연구>, 58, 89-110.

- 보건복지부 (2023, March 31). 제5차 국민연금 재정추계 결과 발표. https://www.mohw.go.kr/board.es?mid=a10503010200&bid=0027&act=view&list_no=375649

- 유지연 (2020). 국민연금과 개인연금 간 대체관계에 관한 연구: 2007년 국민연금 제도변화를 중심으로. 서울대학교 대학원 행정학과 박사학위논문.

- 전병훈·임병인·강성호 (2006). 개인연금 가입 결정 및 가입상태 변화 분석. <보험금융연구>, 17(1), 137-168.

- 전승훈·임병인 (2008). 국민연금자산이 개인연금자산 보유행위에 미치는 영향과 정책시사점. <보험금융연구>, 19(3), 83-117.

- 주은선 (2009). 신자유주의 시대의 연금개혁. <경제와사회>, 84, 70-107.

- 최옥금 (2011). 노인가구의 소비지출 유형화 및 영향요인 분석. <사회정책연합 공동학술대회 자료집>, 2010(1), 1-20.

- 통계청 (2024, August 22). 2022년 연금통계 결과 https://kostat.go.kr/board.es?mid=a10301010000&bid=11816&act=view&list_no=432335

- 홍경준 (2005). 공적연금 체제의 빈곤완화 효과 연구. <사회보장연구>, 21(2), 77-104.